📊 Career Strategy #7: The Portfolio Career

How taking an investor's approach to your own career can pay dividends.

Welcome back to Fuzzy’s Career Strategy Series, where we share research-backed strategies to help you realise your best career.

Part 1: 👋 Introducing the Career Strategy Series

Part 2: 🪜 Ladder Climbing as a Strategy

Part 3: 👩🎓 Controlled Supply as a Strategy

Part 5: 🔍 Niche-ing as a Strategy

Part 6: 🧱 Skill-stacking as a Strategy

Part 7: 👷 Be A Generalist as a Strategy

Part 8: 📊 The Portfolio Career as a Strategy

Part 9: 📣 Building a Platform as a Strategy

Part 10: 🌊 Wave-surfing as a Strategy

Part 11: 🏗️ Adding Leverage as a Strategy

Part 12: 🌏 Proximity as a Strategy

Part 13: ⏱️ Sequencing as a Strategy

Part 14: 🧪 Optimising for Discovery as a Strategy

Part 15: ⚡ Do What Gives You Energy as a Strategy

Part 16: 💹 Arbitrage as a Strategy

There are thousands of possible pathways for your career, but our research found there are ~10-15 dominant career strategies, which can be layered together if needed - and we’ll be breaking those down for you in this series.

'“A career is a portfolio of projects that teach you new skills, gain you new expertise, develop new capabilities, grow your colleague set, and constantly reinvent you as a brand.”

Tom Peters

👷 Introducing Strategy #7: The Portfolio Career

As a society, we assume that we should diversify in some areas of our lives - like our investing portfolios - to maximise growth and minimise volatility.

But we assume that we should go ‘all in’ in other areas, like our jobs.

Working a 9-to-5 for one employer is seen as the norm - and other patterns of work are often seen as risky, a signal of failure or in need of explanation.

In fact, we often put pressure on our 9-to-5 jobs to meet all of our career needs, all at once - whether it’s money, a great team, work-life balance, learning, social impact, or other benefits.

And not unlike the modern tendency to expect our romantic partners to be everything to us - lover, friend, counsellor, co-carer - this tendency to expect one job to meet all of our needs can also be an unrealistic expectation.

But what if you could treat your career the way you treat building wealth - diversifying where you invest your time to create a better overall outcome?

Welcome to the portfolio career - our career strategy this week!

⚙️ How it works.

The metaphor of an investment portfolio is actually a good one here, so let’s start with a simple question:

Why shouldn’t you put all of your money into a single asset?

Well, most financial advisors recommend spreading your money across a range of assets for a few reasons 👇

Reducing volatility: A portfolio spreads investments across different asset classes, sectors, or geographies, reducing the impact of any single investment's poor performance. If one asset declines in value, others may hold steady or rise, helping to balance losses. By diversifying, you can smooth out the ups and downs that come with market fluctuations.

Liquidity: Having investments across various asset classes ensures that some assets may remain liquid and easy to cash out quickly if needed (e.g. stocks) while others (e.g. real estate) may take longer to sell.

Tailored to your risk appetite: A portfolio can be customised to suit your financial goals and risk tolerance. You can adjust it over time as your needs change, whether you're seeking aggressive growth as a young person or steady income as you move into retirement.

🤔 A portfolio approach to your career.

Meet Anil (our hypothetical example):

Anil has a few career needs, which he sometimes feels are in tension:

He really enjoys design, building spreadsheets and mentoring others,

He wants to feel emotionally connected to his work, and is passionate about climate change activism, and

He wants to be well-remunerated and build financial security, and

He wants to be be able to flex his workload up and down over time to accommodate caring responsibilities, since he and his partner are planning to start a family in the next few years.

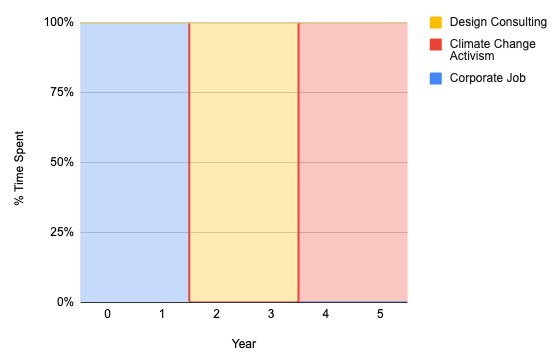

The traditional career.

Anil’s could try to meet all of these needs within a single job - and ending up switching jobs frequently without making progress towards his goals because he always feels like ‘something’s missing’.

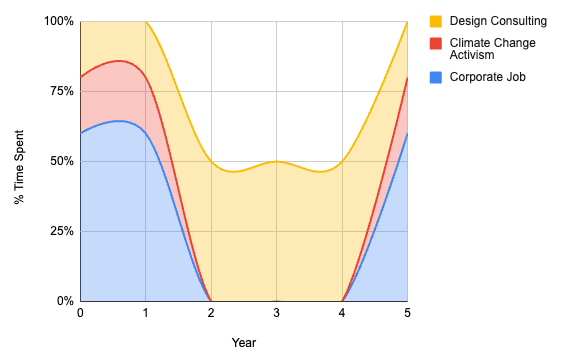

And another version looks like a career portfolio - where he invests his time in different areas, to create a more well-rounded, fulfilling and flexible mix.

He volunteers at a climate change non-profit one day per week and mentors young activists,

He has his own small freelance consultancy business, where he earns a high hourly rate consulting on strategic design projects,

He has a part-time role as a financial analyst in a corporate, which gives him a stable wage for when his first child arrives - and allows him to use the numbers side of his brain,

When he takes parental leave, he decides to maximise time with his family, so he takes a couple years off his corporate and volunteering roles, and increases the hours spent on his consulting business to make up the financial gap - allowing him to work flexibly half the week from home.

Putting that in terms of our investment metaphor - by taking a portfolio approach, Anil can:

Reduce volatility 🫣

Anil is able to smooth out the ups and downs of different jobs to meet many of his career needs at once - financial stability, enjoyable work, family time and a mission he cares about.

He’s also better prepared for external shocks - for example, if much of the design workforce is rapidly made obsolete by changes in technology, or he ends up with a terrible boss in his corporate career, he has the ability to rebalance towards his other skillsets.Increase liquidity 💸

Rather than being locked in to a single job description and career path, by maintaining a few areas of skill he’s able to ‘cash out’ more quickly when it’s important to prioritise earning, or to buy back enough time to invest in building skills which might take a long time to build later on.Tailor his work to his risk appetite 🏠

When Anil’s appetite for growth and challenge at work shifts because he wants to invest his time in home and family, he’s able to make a transition without having to change careers or experience a dramatic reduction in his financial security.

🔋 Powering a career change with the portfolio approach.

Why a portfolio approach can also be an excellent tool for making a career pivot, transition or change.

Lots of people fall into the trap of thinking, “if I want to make a career change, I have to be fully committed”.

Actually, the opposite is often true.

Say you’re a lawyer, who wants to become a podcaster - or a carpenter who wants to become a lawyer, or a podcaster who wants to become a carpenter!

You have specialised skills that you can already command a high rate of pay with - and you want to acquire the skills & credentials for your new role.

Rather than putting pressure on yourself to make a 180-degree change overnight from one field to another, you can:

Use the most highly-remunerated skills you’ve already built (e.g. switching from a full-time role to part-time consulting or contract work which pays a higher hourly rate), while

Investing the time you’ve freed up into learning your new craft, volunteering to gain experience & doing projects to build a track record.

This actually came up on a recent episode of You’re In Good Company, a great personal finance podcast, where Lucy spoke about her experiences.

You can listen to a clip here and the full episode here.

Keep in mind 🧠

A portfolio approach can be a great fit for certain professionals, but you should also consider:

🤯 The costs of context-switching: Changing between jobs from day to day (or even minute-to-minute) has a cognitive cost - our brains need time to reset, call up the relevant information about the job we’re focussing on and settle into our new tasks. The neuroscience tells us that a little bit of variety can be good for our creativity and productivity - but too much context-switching can make us much less effective.

📈 Having ‘go all in’ criteria: Like in investing, sometimes there can be moments where the right decision is actually to commit 100%. It could be a business idea whose time has come, an invitation to take on a challenging new leadership role or realising that you found your passion and you do your best work when you have a single focus. Whatever the reason - if you’re considering a portfolio career, think about when and why you might decide to make a full-time commitment again.

🔮 Case study: the portfolio career expert, Anna Mackenzie.

Note from Lucy:

As a founder, I’ve had the pleasure of working with Anna Mackenzie in multiple capacities - as a consultant advising my business Normal on breaking into retail, as a great all-around operator I’ve pitched to top influencers we work with to help them build ecommerce brands around their followings, and as an early hire at a logistics startup supporting our brand’s fulfilment.

She’s already lived a portfolio career (check out her LinkedIn below):

In addition to those many roles, or perhaps because of them, Anna is also a leading expert on portfolio careers - what they are, how to get into them, and how to thrive in them.

And she shares her advice through her popular newsletter Anna Mack’s Stack.

So when we decided to cover this strategy for Fuzzy, we knew Anna was the perfect person to share a perspective - and she’s given us excerpts from two of her most popular posts for you below!

Excerpt 1: defining a portfolio career.

A portfolio career is defined as having several part-time jobs or multiple income streams rather than one full-time gig.

In my mind, it has two defining characteristics:

It involves pursuing multiple passions, interests and types of work

It’s never static and always evolving

To me, a portfolio career can be made up of many things:

A part time job (eg. working 3 days a week for a company)

A part time business (eg. working 3 days a week for your own company)

A done-for-you service (eg. contracting, consulting)

A done-with-you offer (eg. coaching, mentoring, advising)

A do-it-yourself offer (eg. a digital product, online course)

Creative work (eg. writing, podcasting, Tiktok-ing, playing music)

Giving back (eg. volunteering, pro-bono work)

A mix of any or all of the above

This type of structure is loosely defined by design. It’s the architect who makes and sells pottery on the side. It’s the freelance lifestyle writer moonlighting in PR and comms. It’s the management consultant who manage consults to their own little black book of clients. It’s the CFO-turned-business-coach selling a course for founders on how to streamline their cash.

Want more from Anna about defining portfolio careers? Read this post.

Except 2: Big challenges & trade offs of the PC path.

1. Dealing with the perceived loss of status when leaving a fancy job to build something that others don’t understand.

When you decide to walk away from [insert sexy job title here], you’re probably going to face an existential identity crisis. Who am I, if not a CEO? What am I good for, without the backing of [insert high status company name here]? Where do I stand, without the status of my job? This is a hard one to overcome because there’s tension: we want to follow our heart and pursue our dreams, yet constantly compare ourselves to those we’ve left behind.

"I look at my friends who are high up at [brand] with good salaries and jobs and sometimes I wish I was there, even though deep down I know I don’t want to be. How do you escape the story that a portfolio career is a step back rather than a step forward?"

2. Believing a financially lucrative portfolio career is possible.

Multiple income streams sounds great in principle, but is it actually feasible? Is it really viable? According to my research, some (but not all) people are sceptical about whether they can replace their annual salary, let alone out-earn it. My thoughts: it’s not easy but is it possible? Absolutely.

“Financial stability is my main concern. Giving up a reasonably secure and well paid corporate career that I’ve built for 16 years is a scary proposition.”

3. Packaging up your skills and experience into a clearly defined offer.

This one is such a struggle because it flips everything on its head:

Current system: the employer scopes a role, creates a position description and may or may not put up an ad. You review the position description, make a judgement about whether you’re a good fit, and apply or put yourself forward.

New system: you’re the product. You have to scope out your capabilities and package them up with a price. You must communicate them in a way that makes sense. Prospects make an assessment about fit based on what you project, and decide whether or not to engage you.

Don’t get me wrong, the whole ‘think of yourself as a product’ thing is tough, but a lot of people get stuck believing they need the perfect offer, perfect pricing, perfect tagline and perfect pitch before they start approaching others. But in my experience, conversations with prospects should inform your offer, not the other way around.

“I'm doing all these different things with different people who remember me for various reasons, but I don’t know how to articulate that as ‘this is what I do’. I think it’s the control freak in me that needs everything to be perfectly defined, and it’s keeping me stuck.”

Generating work beyond people that you know.

Your first few clients will inevitably be people you know. Your next few will likely be people who know people you know. But what comes after your network (hot leads) and your network’s network (warm leads) are exhausted? How do you win work from cold, hard sales? This question came up a lot.

“I haven’t had to do any formal sales yet because all my current clients have come through my network. But I need to have a plan for when I have to eventually go out and generate work beyond the people that I know. And I have no clue what that plan is meant to be.”

Loneliness.

The inevitable trade off of freedom, flexibility and autonomy is the loneliness that comes from operating as a silo. We all crave community, good conversation, feedback on our work and encouragement that we’re on the right path. The need for connection is universal.

“I don’t know anyone else who has a portfolio career, there isn’t anyone in my inner circle doing something similar. I sometimes find it lonely and struggle with the uncertainty of it all.”

Want more from Anna on the challenges of portfolio careers? Read this post.

Looking to showcase your skills, but feel limited by a LinkedIn profile?

We absolutely love the Fingertip tool: check out Lucy’s here as an example 👇

Why we love it:

Easy to personalise

No coding or design skills needed

Under 10 minutes to set up

Easy to share in any format (link, QR code, etc)

Polished & visually stunning

List services, book appointments, highlight your content & more

Feel free to comment or DM us with questions - and you can enjoy 20% off as a Fuzzy subscriber when you click the button below!

Found this post helpful?

We created this series to help everyone realise their best careers, and we’d love you to share a post with your friends, family, colleagues and networks 📣

Keen for more? Check out the other posts in the series 👇

Part 1: 👋 Introducing the Career Strategy Series

Part 2: 🪜 Ladder Climbing as a Strategy

Part 3: 👩🎓 Controlled Supply as a Strategy

Part 5: 🔍 Niche-ing as a Strategy

Part 6: 🧱 Skill-stacking as a Strategy

Part 7: 👷 Be A Generalist as a Strategy

Part 8: 📊 The Portfolio Career as a Strategy

Part 9: 📣 Building a Platform as a Strategy

Part 10: 🌊 Wave-surfing as a Strategy

Part 11: 🏗️ Adding Leverage as a Strategy

Part 12: 🌏 Proximity as a Strategy

Part 13: ⏱️ Sequencing as a Strategy

Part 14: 🧪 Optimising for Discovery as a Strategy

Part 15: ⚡ Do What Gives You Energy as a Strategy

Part 16: 💹 Arbitrage as a Strategy

Thanks for this post, I love the idea ! I'm starting to build my own portfolio!

Great outline of how to start constructing a new path. Particularly useful for those with unorthodox backgrounds.